Aim of the study

To conduct a study of production volumes and ways of naphthalene processing, to identify market trends in Russia and abroad.

Research objectives

Evaluation of the market in the following areas:

- Global naphthalene market

- Volume and dynamics of naphthalene production in Russia

- Naphthalene market segmentation according to processing directions

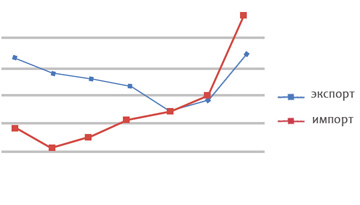

- Export and import of naphthalene from / to the Russian Federation

Geography research

RF, global market

Methodology

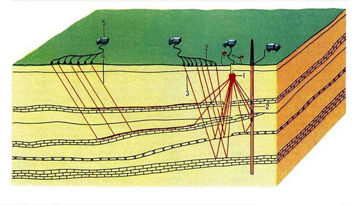

• analysis of statistical data, specialized literature and website data of companies producing and consuming naphthalene;

• information of companies offering solutions for the transportation and storage of naphthalene;

• analysis of foreign economic activity

When analyzing foreign trade, the TNVED code was used:

2707 40 - Distillation products of coal tar - naphthalene

In the analysis of rail transport the following codes of Ministry of Railways were used:

Old nomenclature - 71,131

Classes of transport rates, new nomenclature - 49,146

CONTENTS

INTRODUCTION

GENERAL INFORMATION ABOUT NAPHTHALENE

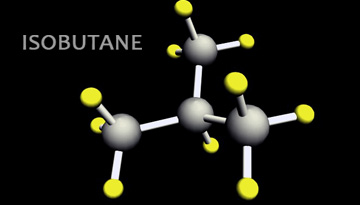

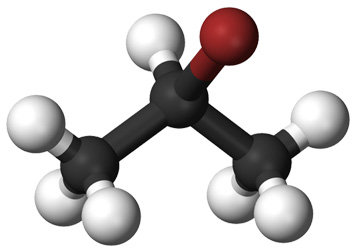

PHYSICOCHEMICAL PROPERTIES

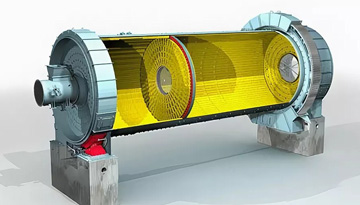

PRODUCTION TECHNOLOGIES

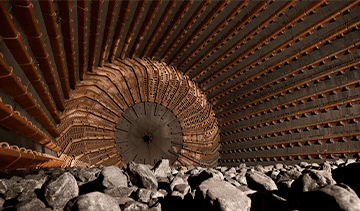

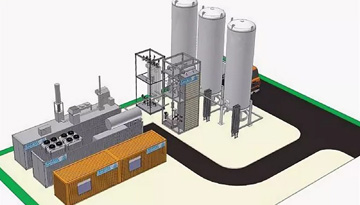

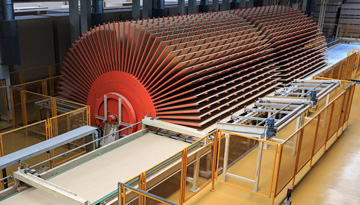

COAL TAR PROCESSING

OIL REFINING

MANUFACTURE OF CRYSTALLINE NAPHTHALENE

DEVELOPMENT TRENDS OF THE GLOBAL MARKET

PRODUCTION

PRODUCTION DYNAMICS

WORLD PRODUCTION STRUCTURE BY REGION

PRODUCTION STRUCTURE BY TECHNOLOGY

CONSUMPTION

CONSUMPTION STRUCTURE BY INDUSTRY

DEVELOPMENT PROSPECTS FOR CONSUMING INDUSTRIES

PHTHALIC ANHYDRIDE

NAPHTHALENE SULFONATES

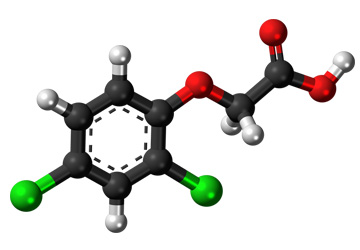

PLANT PROTECTION PRODUCTS

FORECAST OF NAPHTHALENE CONSUMPTION IN THE GLOBAL MARKET

BALANCE OF SUPPLY AND DEMAND OF NAPHTHALENE IN THE GLOBAL MARKET

EXPORT AND IMPORT SUPPLIES OF NAPHTHALENE IN THE GLOBAL MARKET

NAPHTHALENE PRICES IN THE GLOBAL MARKET

RUSSIAN MARKET

PRODUCTION

PRODUCTION DYNAMICS

DISTRIBUTION OF NAPHTHALENE PRODUCTION BY COMPANY AND REGION

INTERNATIONAL TRADE

DYNAMICS AND GEOGRAPHICAL STRUCTURE OF RUSSIAN NAPHTHALENE EXPORTS

IMPORT DYNAMICS AND STRUCTURE

MAJOR RUSSIAN CONSUMERS OF FOREIGN-MADE NAPHTHALENE

CONSUMPTION

CONSUMPTION STRUCTURE BY REGION

CONSUMPTION STRUCTURE BY INDUSTRY

CONSUMPTION DYNAMICS AND FORECAST

THE LARGEST CONSUMERS OF NAPHTHALENE IN THE RUSSIAN MARKET (VOLUMES, DYNAMICS OF PURCHASES)

RUSSIAN NAPHTHALENE MARKET PRICES

LIST OF DIAGRAMS

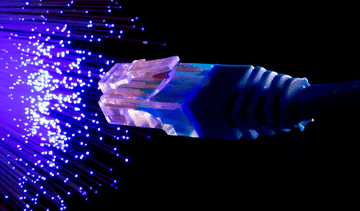

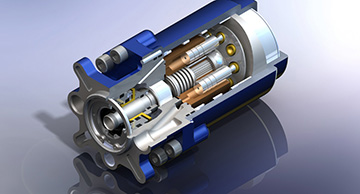

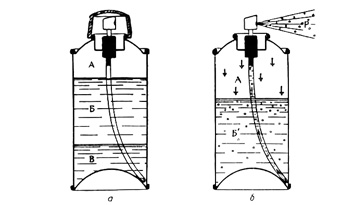

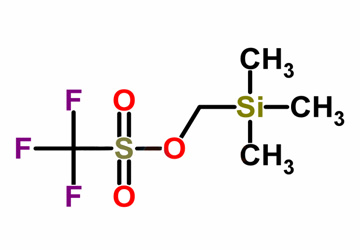

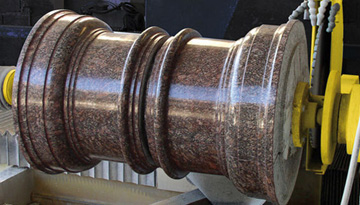

Figure 1. Scheme of rectification of coal tar in a tubular unit with a single column

Figure 2. Dynamics of global production of naphthalene, 2000-11, thousand tons

Figure 3. Dynamics of naphthalene production by region and country, 2000-11, thousand tons

Figure 4. Changes in the ratio of naphthalene production in China and developed countries of the world, 2000–11, kt,%

Figure 5. Structure of naphthalene consumption in the world by industry, thousand tons,%

Figure 6. Structure of naphthalene consumption in main regions and countries by industry, thousand tons,%

Figure 7. The structure of global consumption of phthalic anhydride by region and country,%

Figure 8. The structure of global consumption of phthalic anhydride by industry,%

Figure 9. Structure of global consumption of construction additives by region and country, billion USD

Figure 10. Dynamics of consumption of naphthalene in the world, forecast up to 2015 thousand tons,%

Figure 11. Dynamics of consumption of naphthalene by region and country, 2000-11, thousand tons

Figure 12. Changes in the balance of supply and demand of naphthalene in the world, 2000-11, thousand tons

Figure 13. Changes in the balance of supply and demand of naphthalene in the leading regions and countries of the world, 2000-11, thousand tons

Figure 14. Leading net exporters and net importers of naphthalene, kt

Figure 15. Dynamics of naphthalene exports by supplying countries., kt

Figure 16. Structure of naphthalene import by countries, thousand tons,%

Figure 17. Dynamics of average export and import prices on naphthalene, years, USD / ton

Figure 18. Dynamics of coal prices in some countries producing naphthalene, 2005–08, USD / ton

Figure 19. Dynamics of import prices on naphthalene in China and some European countries, USD / ton

Figure 20. Dynamics of export prices for naphthalene of the leading exporting countries, USD / ton

Figure 21. The share of Russian naphthalene production in the global market, thousand tons,%

Figure 22. Dynamics of coke and naphthalene production in the Russian Federation, 2005-11, thousand tons

Figure 23. Structure of the Russian production of naphthalene by leading companies, 2011, thousand tons,%

Figure 24. Changes in the production of naphthalene by enterprises, 2008-11,%

Figure 25. Dynamics of naphthalene production in the Russian Federation by production companies, 2008-11, thousand tons

Figure 26. Structure of the Russian production of naphthalene by federal districts, 2011, thousand tons,%

Figure 27. Dynamics of naphthalene supplies to the domestic market of the Russian Federation by manufacturing companies, 2008-11, thousand tons

Figure 28. Structure of naphthalene supplies to the Russian market by manufacturing companies, 2011, kt,%

Figure 40. Dynamics of naphthalene exports from the Russian Federation, 2005-11, thousand tons

Figure 41. Dynamics of naphthalene exports from Russia by importing countries, 2008-11, thousand tons

Figure 42. Structure of naphthalene exports from Russia by importing countries, 2011, thousand tons,%

Figure 43. Dynamics of export of naphthalene from the Russian Federation by exporting companies, 2008-11, thousand tons

Figure 44. Imports dynamics of naphthalene of the Russian Federation, 2008-11, thousand tons

Figure 45. Dynamics of Russian naphthalene imports by exporting countries, 2008-11, thousand tons

Figure 29. The structure of global consumption of naphthalene by leading regions and countries, 2011, thousand tons,%

Figure 30. Structure of naphthalene consumption in the Russian Federation by industry, 2008-11, thousand tons,%

Figure 31. Dynamics of phthalic anhydride production at ZSMK, thousand tons,

Figure 32. Changes in the structure of naphthalene consumption in the Russian Federation, 2008-11, thousand tons

Figure 33. Dynamics of naphthalene consumption in the Russian Federation, 2005-11, the forecast up to 2015, thousand tons

Figure 34. Dynamics of production and consumption of naphthalene in the Russian Federation, change in the share of processing in the domestic market, 2005-10, thousand tons,%

Figure 35. Dynamics of concrete production and consumption of naphthalene in the Russian Federation, 2008-11, forecast up to 2015

Figure 36. Structure of naphthalene consumption in Russia by company, 2011, thousand tons,%

Figure 37. Changes in the structure of naphthalene consumption in the Russian Federation by company, 2008-11, thousand tons

Figure 38. Polyplast company structure

Figure 39. Dynamics of cement consumption in the Russian Federation and total sales of Polyplast, million tons, billion RUR.

Figure 46. Dynamics of export prices of the Russian Federation for naphthalene in the context of exporting companies, 2008-11, USD / ton

Figure 47. Dynamics of import prices on naphthalene of the Russian Federation by countries-importers and domestic market prices, 2008-11, USD / ton

LIST OF TABLES

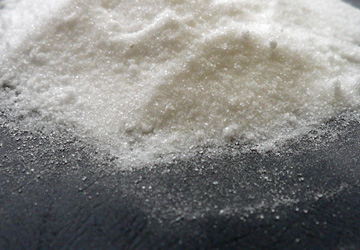

Table 1. The average yield of fractions during the rectification of coal tar

Table 2. Composition of naphthalene fractions of some plants in the CIS

Table 3. The largest manufacturers of naphthalene

Table 4. Properties and scopes of naphtholinsulfonates of Nease corp

Table 6. Consumers of imported naphthalene in the Russian Federation, 2008-11

Table 5. Consumption of naphthalene in domestic production in the Russian Federation by applications and companies, 2008-11, tons