Specification

Summary

Analysis of Russian imports of glass tube medical containers

Analysis of the structure of imports of medical products from glass tubes and raw materials, 2020 – first 8 months of 2022

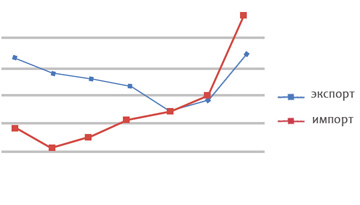

General dynamics of imports and structure by product types, 2020 – first 8 months of 2022

Structure by countries of origin, 2020 – first 8 months of 2022

Detailed analysis of the structure of imports of glass tubing medical products and raw materials, 2020 – first half of 2022

Structure of imports by types of products

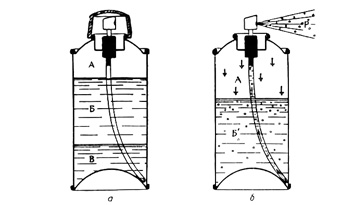

The structure of imports in the context of the capacity of vials / ampoules

Structure of imports by countries of origin and producers

Import structure by recipients

The level of import prices for medical glass containers

General dynamics of prices for glass tube medical products and raw materials, 2020 – first 8 months of 2022

Detailed price dynamics for glass tubing medical products and raw materials, 2020 – first half of 2022

Changes related to February 2022 events

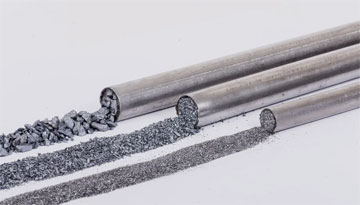

Analysis of the Russian production of medical containers made of glass tubes

Total volume and dynamics of Russian production in 2020 – first half of 2022

Structure of Russian production by enterprises, level of capacity utilization

Export prices of Russian manufacturers

Analysis of Russian exports of glass medical containers

Total volume and dynamics of exports in 2018-2020

Structure of exports by countries of destination

Structure of exports by manufacturers and types of medical containers

Analysis of the Russian market of medical glass containers

Total volume and dynamics of the Russian market in 2020 – first half of 2022

Distribution of market shares among key players

Assessing the impact of February 2022 events on individual manufacturers and the market

Appendices

Appendix 1. Assessment of the structure of imports of glass products by color

Appendix 2. The structure of imports of medical products from glass tubes by recipients and main suppliers

Appendix 3. The structure of imports of medical products from glass tubes by main containers and manufacturers

Appendix 4. Structure of import prices, addition

Appendix 5. Structure of export prices, addition

LIST OF TABLES AND DIAGRAMS

Table 1. Dynamics and structure of Russian imports of medical products from glass tubes and raw materials, 2020-first 8 months of 2022, tons, thousand dollars

Table 2. Dynamics and structure of Russian imports of medical products made of glass tubing and raw materials by product types and months, 2022, tons, thousand dollars

Table 3. Dynamics and structure of Russian imports of medical products made of glass tubing and raw materials by product types and months, 2022, tons, thousand dollars

Table 4. Dynamics and structure of Russian imports of glass tube medical products by countries of origin, first 8 months of 2021/ first 8 months of 2022, tons, thousand dollars

Table 5. Dynamics and structure of Russian imports of glass tube bottles by countries, manufacturers and months, 2022, tons

Table 6. Dynamics and structure of Russian imports of glass tube ampoules by countries, manufacturers and months, 2022, tons

Table 7. Dynamics and structure of Russian imports of glass tube cartridges by countries, manufacturers and months, 2022, tons

Table 8. Dynamics and structure of Russian imports of glass pipes by country of origin, first 8 months of 2021/ first 8 months of 2022, tons, thousand dollars

Table 9. Dynamics and structure of Russian imports of glass pipes (raw materials) by countries, producers and months, 2022, tons

Table 10. Dynamics and structure of Russian imports of glass medical products by product types, 2018 – first half of 2022, tons, thousand dollars, million units

Table 11. Dynamics and structure of Russian imports of glass tube bottles by capacity, 2020 – first half of 2022, tons, thousand dollars, million units

Table 12. Dynamics and structure of Russian imports of ampoules by capacity, 2020 – first half of 2022, tons, thousand dollars, million units

Table 13. Dynamics and structure of Russian imports of medical products made of glass tubes by countries of origin, 2020 – first half of 2022, tons, thousand dollars, million units

Table 14. Dynamics and structure of Russian imports of glass pipes by countries of origin, 2020 – first half of 2022, tons, thousand dollars

Table 15. Dynamics and structure of Russian imports of glass tube medical products by manufacturers, 2020 – first half of 2022, tons, thousand dollars

Table 16. Dynamics and structure of Russian imports of medical products made of glass tubes by types of products and manufacturers, 2020 – first half of 2022, tons, thousand dollars, million units

Table 17. Dynamics and structure of Russian imports of glass tube medical products by recipients, 2020 – first half of 2022, tons, thousand dollars

Table 18. The structure of Russian imports of medical products made of glass tubes by recipients, types of products and main suppliers, 2021, tons, thousand dollars, million units

Table 19. The structure of Russian imports of raw materials for the production of medical glass products by recipients and main suppliers, 2020 – first half of 2022, tons, thousand dollars

Table 20. Dynamics and structure of import prices for medical devices made of glass tubing and raw materials by country of origin, 2020 – first 8 months of 2022, tons, dollars per kg

Table 21. Monthly dynamics of import prices for medical products made of glass tubing and raw materials by product type, first 8 months of 2022, dollars per kg, rubles per kg

Table 22. Dynamics of prices for medical products made of glass tubes by capacity, 2020 – first half of 2022, dollars per kg, cents per unit

Table 23. Dynamics of prices for glass tube bottles by main containers and manufacturers, 2020 – first half of 2022, dollars per kg, cents per unit

Table 24. Dynamics of prices for ampoules in the context of the main containers and manufacturers, 2020 – first half of 2022, dollars per kg, cents per unit

Таble 25. Dynamics of prices for glass tubes by main diameters, 2020 – first half of 2022, dollars per kg

Table 26. Price dynamics for glass tubes produced by Schott AG by color, 2020 – first half of 2022, dollars per kg

Table 27. EU sanctions on import/export to Russia, approved on 08 April 2022

Table 28. The impact of the events of February 2022 on the import of glass tubing medical products and raw materials

Table 29. Dynamics and structure of the Russian production of glass medical products by product types, 2018-2020, tons, million rubles, million units

Table 30. List of studied Russian manufacturers of medical devices (vials and ampoules)

Table 31. Dynamics and structure of the Russian production of medical products from glass tubes by manufacturers and types of products, 2020 – first half of 2022, tons, million rubles, million units

Table 32. Changes in the Russian manufacture of medical products from glass tubes by manufacturers and types of products, first half of 2021 / first half of 2022, tons, million rubles, million units

Table 33. Capacities and capacity utilization of Russian manufacturers of glass tube medical products

Table 34. Dynamics of average export prices for glass tube bottles by manufacturer and capacity, 2020 – first half of 2022, dollars per kg, cents per unit

Table 35. Dynamics of average export prices for glass tube bottles by capacity and manufacturers, 2020 – first half of 2022, cents per unit

Table 36. Dynamics of average export prices for ampoules by manufacturers and capacity, 2020 – first half of 2022, dollars per kg, cents per unit

Table 37. Dynamics of average export prices for ampoules by capacity and manufacturers, 2020 – first half of 2022, cents per unit

Table 38. Dynamics of average export prices for glass pipes, 2020 – first half of 2022, dollars per kg

Table 39. Dynamics and structure of Russian exports of glass medical products by product types, 2018 – first half of 2022, tons, thousand dollars, million units

Table 40. Dynamics and structure of Russian exports of medical products made of glass tubes by countries of destination, 2020 – first half of 2022, tons, thousand dollars, million units

Table 41. Dynamics and structure of Russian exports of glass tube medical products by product types and countries of destination, 2020 – first half of 2022, tons, thousand dollars, million units

Table 42. Dynamics and structure of Russian exports of glass tube medical products by manufacturers and types of products, 2020-2021, tons, thousand dollars, million units

Table 43. Dynamics and structure of the Russian market of glass medical devices by product types, 2018 – first half of 2022, tons, million rubles, million units

Table 44. Dynamics and structure of the Russian market of medical devices made of glass tubes by types of products and market parameters, 2020 – first half of 2022, tons, million rubles, million units

Table 45. The structure of the Russian market of medical devices made of glass tubes by key players, 2021, tons, million rubles, million units

Table 46. The current situation with the purchase of raw materials (glass pipes) by manufacturers

Table 47. Monthly dynamics and structure of Russian imports of glass pipes (raw materials) by importers and countries of origin, 2022, tons

Table 48. Dynamics and structure of Russian imports of medical products made of glass and raw materials (glass tubes) by color, 2020 – first half of 2022

Table 49. The structure of Russian imports of medical products made of glass tubes by recipients, types of products and main suppliers, 2021, tons, thousand dollars, million units

Table 50. The structure of Russian imports of glass tube bottles by main containers and manufacturers, 2020 – first half of 2022, tons, thousand dollars, million units (net transactions only)

Table 51. Structure of Russian imports of ampoules by main containers and manufacturers, 2020 – first half of 2022, tons, thousand dollars, million units (net transactions only)

Table 52. Structure of weighted average import prices for glass tube bottles by manufacturers, 2021 – first half of 2022, dollars per ton

Table 53. Structure of weighted average import prices for glass tube bottles by manufacturers and containers, 2020 – first half of 2022, dollars per ton

Table 54. Structure of weighted average import prices for ampoules and cartridges by manufacturers, 2021 – first half of 2022, dollars per ton

Table 55. Structure of weighted average import prices for glass tubes for the production of medical devices by manufacturers, 2021 – first half of 2022, dollars per ton

Table 56. Dynamics of average export prices for glass tube medical products by manufacturers, product types and capacity, 2020 – first half of 2022, dollars per kg, cents per unit

Diagram 1. Dynamics of Russian imports of glass tube medical products by product types, 2018 – first half of 2022 (actual), 2022 (estimation), thousand tons, million dollars

Diagram 2. Share distribution of Russian imports of glass tube medical products by country of origin, 2020 – first half of 2022, % (tons)

Diagram 3. Share distribution of Russian imports of glass pipes by countries of origin, 2020 – first half of 2022, % (tons)

Diagram 4. Dynamics of Russian production of medical products from glass tubes by product types, 2018 – first half of 2022 (actual), 2022 (estimation), thousand tons, million rubles

Diagram 5. Share distribution of Russian production of medical products from glass tubes by product types, 2021, % (tons), % (rubles), % (units)

Diagram 6. Share distribution of Russian production of medical products from glass tubes by manufacturers, 2021, % (tons)

Diagram 7. Share distribution of Russian exports of medical products from glass tubes by country of destination, 2021, % (tons), % (dollars), % (units)

Diagram 8. Dynamics of the Russian market of medical devices made of glass tubes by product types, 2018 – first half of 2022 (actual), 2022 (estimation), thousand tons, million rubles

Diagram 9. The share of imports in the Russian market of medical devices made of glass tubes by product type, 2021, % (tons), % (rubles), % (units)

Diagram 10. The share of exports from the Russian production of medical products from glass tubes by product type, 2021, % (tons), % (rubles), % (units)